Insurance If your financial institution will be keeping an escrow account, billing you, and handling the payment of your property insurance then include that yearly amount here. Taxes If your financial institution will be keeping an escrow account, billing you, and handling the payment of your property taxes then include that yearly amount here. Note that this is the interest rate you are being charged which is different and normally lower than the Annual Percentage Rate (APR). loan calculator, enter your pre-tax income. Mortgage Amount the original principal amount of your mortgage when calculating a new mortgage or the current principal owed when calculating a current mortgage Mortgage Term the original term of your mortgage or the time left when calculating a current mortgage Interest Rate the annual nominal interest rate or stated rate on the loan. Use the helpful mortgage calculator, on MarketWatch, to estimate mortgage payments, including principal and interest, taxes, PMI and insurance. Avoid private mortgage insurance: When you put at least 20 down on a conventional loan or 20. Mortgage calculator without taxes and insurance. This is a good estimate when keeping taxes and insurance in an escrow account the payment charged by your financial institution could be different.įor a simple calculation without insurance and taxes, use this Note: As of July 9, 2012, the maximum amortization period for mortgages with less than a 20 percent down payment is 25 years. When calculating a new mortgage where you know approximately your annual taxes and insurance, this calculator will show you the monthly breakdown and total. HOA fees: If your home is a part of a homeowners association (HOA), you may have to pay an additional monthly fee.Calculate your total monthly mortgage payment. With the onset of the COVID-19 pandemic in early 2020, unemployment rates rose as high as 14.7 in April, according to the Bureau of Labor Statistics.Many households struggled to make mortgage payments between April to July 2020.Again, you can get a better estimate by entering a more accurate number for your situation, if you know it. Homeowners insurance: Lenders require that you purchase homeowners insurance, and we have it set to the typical cost.

If your down payment is less than 20, the estimated monthly PMI charge displays. Our calculator’s default is on the high end of what you might pay, but you can get a more accurate estimate by finding out the specific rate for your potential property. Use this mortgage payment calculator with taxes and insurance to find your. Property taxes: How much you’ll owe the government in property taxes.APR: This is the financing cost of the loan that you’ll pay over time with each monthly payment, expressed as a percentage (annual percentage rate, to be specific).

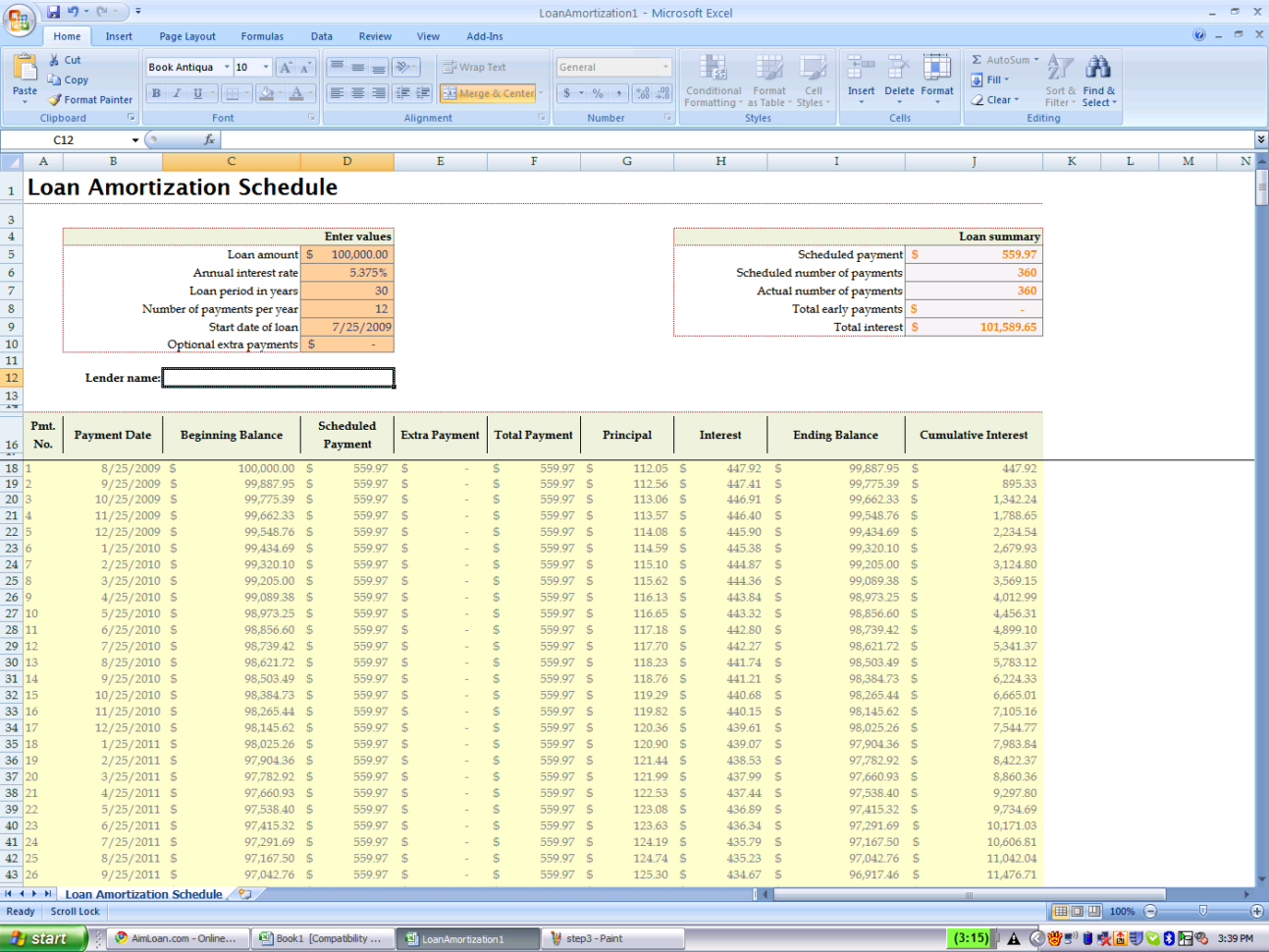

A 30-year mortgage is common (and is the default here), but other terms are also available. For example, if your loan is 100,000, and your annual mortgage insurance is 1.0 percent, youd pay 1,000 for mortgage insurance in a year.

0 kommentar(er)

0 kommentar(er)